The Driving Force in Technology: Chemical Mechanical Polishing in 2025

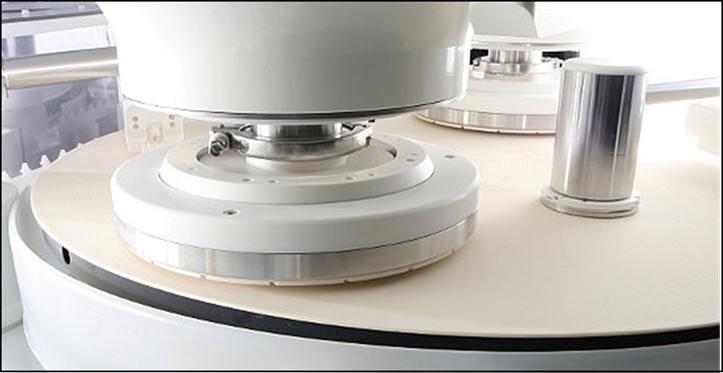

Chemical Mechanical Polishing (CMP) has become one of the fundamental processes enabling the production of cutting-edge microelectronic devices. As next-generation technologies demand higher performance, smaller chip geometries, and flawless wafer surfaces, CMP continues to evolve, underpinned by global innovation, partnership, and substantial investment.

According to Straits Research, the global chemical mechanical polishing segment was valued at USD7.14 billion in 2024 and is expected to grow from USD7.64 billion in 2025 to reach USD13.13 billion by 2033, rising at a 7% CAGR during the period 2025-2033. This strong outlook underscores CMP’s pivotal role in emerging applications and its close ties to industries such as semiconductors, MEMS, and advanced electronics.

CMP Industry Leaders and Competitive Landscape

The CMP space is shaped by well-established multinational companies and innovative specialists, each contributing to pushing technological boundaries:

-

Applied Materials (USA): A global technology giant, Applied Materials continually pioneers new CMP equipment and consumables, focusing on enhanced yield and precision for advanced nodes and 3D structures.

-

Ebara Corporation (Japan): Ebara remains at the forefront by launching new-generation polishing systems tailored for semiconductor fabrication plants in Asia-Pacific, the sector’s most dynamic region.

-

Cabot Microelectronics Corporation (USA): Renowned for its advanced slurries, Cabot’s R&D is critical to enabling more precise planarization and lower defect rates at sub-5nm and 3nm nodes.

-

DuPont Electronic Solutions (USA): A major innovator in CMP pads and consumables, focusing on green chemistry and cost-effective, high-durability solutions.

-

Fujimi Incorporated (Japan): Specializes in customized slurries for various wafer applications, supporting the world’s top fabs in Japan, Taiwan, and China.

-

Lapmaster Wolters GmbH (Germany), Okamoto Corporation (Japan), KC Tech (South Korea), ACCRETECH (Tokyo Seimitsu, Japan), and Revasum Inc. (USA): These players focus on niche segments, highly specialized machines, and country-specific needs, such as fine optics or MEMS production.

Global and Regional Developments

Asia-Pacific: Semiconductor Powerhouse

Asia-Pacific, anchored by China, Taiwan, Japan, and South Korea, commands the largest share of global CMP usage. China’s aggressive expansion in semiconductor manufacturing—with heavy investments and the launch of new fabs—continues to fuel demand for CMP systems and consumables. Taiwan’s TSMC stands out as the top contract chipmaker, driving innovation in slurries and pads for ever-shrinking geometries and new dielectrics. Japan’s suppliers like Ebara, Fujimi, and Okamoto not only address local industry needs but export heavily across Asia and the rest of the world.

North America: R&D and Advanced Packaging

The U.S. maintains a global edge through deep research, close semiconductor industry collaborations, and the rapid commercialization of new materials and slurries. The country’s focus on advanced logic, memory, and 3D packaging naturally bolsters demand for next-generation CMP equipment from Applied Materials, Cabot, 3M, Entegris, and DuPont. The push for domestic chip manufacturing—spurred by government incentives—continues to drive investment in cutting-edge CMP solutions.

Europe: Specialty and Sustainability

Europe, led by Germany and partners in advanced optics and MEMS, invests heavily in highly automated and green manufacturing, with providers such as Lapmaster Wolters and specialist chemistry suppliers supporting local fabs and exporting globally. There’s rising push for the miniaturization of sensors for automotive, medical, and IoT applications, creating a strong need for precision CMP.

Emerging Markets

The Middle East, especially Israel, is investing in advanced wafer fabrication. India’s focus on electronic manufacturing and indigenous memory production is bringing new opportunities for local and global CMP equipment vendors.

Technological Trends and Growth Dynamics

Several major trends characterize the current and future evolution of CMP:

-

Miniaturization and 3D Packaging: Increasingly smaller IC structures and adoption of 3D stacking require more precise and advanced CMP to ensure perfect wafer flatness and rapid production cycles.

-

High-Performance, Low-Defect Consumables: Developing new pads and slurries tailored for sub-7nm processes and compound semiconductors is a critical growth driver. Long-life pads and low-abrasion slurries are becoming the new norm.

-

Automation and Smart Manufacturing: Intelligent CMP systems with built-in data analytics help in reducing defects, lowering costs, and enabling closed-loop control for higher fab yields.

-

Green Chemistry: As environmental concerns rise, major competitors (DuPont, 3M, Entegris) actively pursue eco-friendly formulations and recycling technologies.

-

Integrated Systems: Manufacturers are moving toward delivering integrated lines that combine slicing, probing, and polishing in compact footprints, reducing costs and space for fab operators.

-

Geopolitical Supply Chain Diversification: With ongoing global supply chain uncertainties, manufacturers in the U.S., Asia, and Europe are localizing key supplies, forming strategic partnerships, and broadening their supplier base.

Latest News and Noteworthy Updates

-

In March 2024, new high-performance pads and slurries were released, further raising yields for next-gen electronics.

-

Ebara’s new product launches in Japan and Taiwan are equipping emerging local fabs for advanced logic and memory production.

-

Applied Materials and DuPont announced strategic partnerships with major U.S. fabs to co-develop greener, more durable CMP consumables.

-

Taiwan’s TSMC, along with Japanese suppliers, continue to break ground in 2nm and sub-2nm technology, accelerating R&D into compatible CMP solutions.

Article Summary

Chemical Mechanical Polishing has become essential to semiconductors, advanced packaging, and modern electronics. The sector’s future depends on continued innovation, global collaboration, and sustained investment. Leading players across the U.S., Asia, and Europe are advancing technology, focusing on sustainability, precision, and performance.

- Vibnix Blog

- Politics

- News

- Liberia News

- Entertainment

- Technology

- Formazione

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness