Financial Crime and Fraud Management Solutions Market Overview, Growth Analysis, Trends and Forecast By 2029

Regional Overview of Executive Summary Financial Crime and Fraud Management Solutions Market by Size and Share

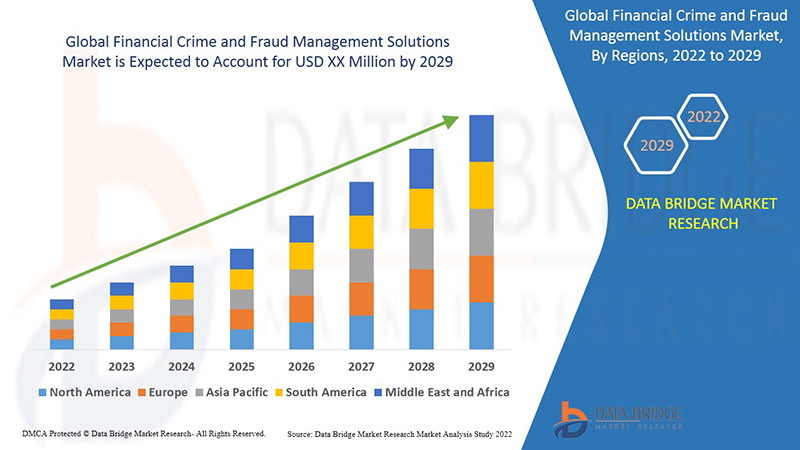

Data Bridge Market Research analyses that the financial crime and fraud management solutions market will exhibit a CAGR of 4.7% for the forecast period of 2022-2029.

With the superior Financial Crime and Fraud Management Solutions Market report, get knowledge about the industry which explains what market definition, classifications, applications, engagements and market trends are. This report reveals the general market conditions, market trends, customer preferences, key players, current and future opportunities, geographical analysis and many other parameters that help drive the business into the right direction. The parameters of winning Financial Crime and Fraud Management Solutions Market research report range from industry outlook, market analysis, currency and pricing, value chain analysis, market overview, premium insights, key insights to the company profile of the key market players.

Besides, with the help of an influential Financial Crime and Fraud Management Solutions Market report, businesses can make out the reaction of the consumers to an already existing product in the market. This Financial Crime and Fraud Management Solutions Market research report gives details about the market definition, market drivers, market restraints, market segmentation with respect to product usage and geographical conditions, key developments taking place in the market, competitor analysis, and the research methodology. The analysis and estimations carried out via Financial Crime and Fraud Management Solutions Market research report assist to get the details about the product launches, future products, joint ventures, Market strategy, developments, mergers and acquisitions and effect of the same on sales, Market, promotions, revenue, import, export, and CAGR values.

Learn how the Financial Crime and Fraud Management Solutions Market is evolving—insights, trends, and opportunities await. Download report:

https://www.databridgemarketresearch.com/reports/global-financial-crime-and-fraud-management-solutions-market

Financial Crime and Fraud Management Solutions Market Introduction

**Segments**

- Based on Component: The financial crime and fraud management solutions market can be segmented into solutions and services. The solutions segment includes fraud detection and prevention, anti-money laundering, compliance management, and risk assessment. The services segment comprises professional services and managed services.

- By Deployment Mode: This market can be categorized into on-premises and cloud-based deployment models. On-premises solutions require local installation and maintenance, offering more control to organizations. In contrast, cloud-based solutions provide flexibility, scalability, and cost-effectiveness.

- Through Organization Size: The market can also be classified based on organization size, including small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly adopting financial crime and fraud management solutions to protect their businesses from sophisticated cyber threats.

- According to Vertical: The market can further be segmented into verticals such as banking, financial services, and insurance (BFSI), retail, healthcare, government, and others. The BFSI sector is a significant adopter of financial crime and fraud management solutions due to the high volume of financial transactions and sensitive customer data.

**Market Players**

- SAS Institute Inc.: SAS offers a comprehensive suite of fraud and financial crimes solutions that leverage advanced analytics, AI, and machine learning capabilities to detect and prevent fraudulent activities in real-time.

- IBM Corporation: IBM provides a range of financial crime management solutions, including IBM Safer Payments, IBM Counter Fraud Management, and IBM Financial Crimes Insights, helping organizations mitigate risks and protect against financial crimes.

- Oracle Corporation: Oracle offers a robust portfolio of fraud detection and prevention solutions, such as Oracle Financial Services Analytical Applications, enabling organizations to combat money laundering, fraud, and other financial crimes effectively.

- FICO: FICO's solutions, such as FICO Falcon Fraud Manager and FICO Financial Crime Compliance, leverage predictive analytics and artificial intelligence to detect and prevent financial crimes across various industries globally.

- NICE Actimize: NICE Actimize delivers innovative financial crime management solutions, including NICE ActOne, NICE ActimizeWatch, and X-Sight, facilitating organizations in managing regulatory compliance and combating financial fraud effectively.

The financial crime and fraud management solutions market continues to evolve rapidly as organizations across various industries strive to safeguard their operations against increasingly sophisticated cyber threats. One emerging trend in the market is the growing emphasis on AI and machine learning technologies to enhance fraud detection and prevention capabilities. These advanced technologies enable businesses to conduct real-time monitoring and analysis of vast amounts of data to identify anomalies and potential fraudulent activities more efficiently. As the volume and complexity of financial transactions increase, the demand for AI-driven solutions is expected to rise, driving innovation and competition among market players.

Another key development in the financial crime and fraud management solutions market is the shift towards integrated platforms that offer a holistic approach to addressing multiple types of financial crimes. Integrated solutions that cover fraud detection, anti-money laundering, compliance management, and risk assessment provide organizations with a centralized system for monitoring and mitigating various threats. By consolidating these functions into a single platform, businesses can streamline their operations, reduce complexity, and improve overall efficiency in managing financial crime risks.

Additionally, regulatory compliance requirements continue to shape the landscape of the financial crime and fraud management solutions market. With stringent regulations in place to combat money laundering, fraud, and other financial crimes, organizations are under pressure to implement robust compliance programs and strategies. Market players are responding by developing solutions that not only detect and prevent fraudulent activities but also ensure adherence to regulatory standards and reporting requirements. This focus on compliance is driving the adoption of comprehensive financial crime management solutions that offer both security and regulatory compliance functionalities.

Moreover, the increasing adoption of cloud-based deployment models is having a significant impact on the market dynamics. Cloud solutions provide organizations with greater flexibility, scalability, and cost-effectiveness compared to traditional on-premises systems. This shift toward cloud deployment is driven by the need for agility and accessibility as businesses strive to stay ahead of evolving fraud schemes and cyber threats. As more companies transition to cloud-based financial crime and fraud management solutions, market players are investing in enhancing their cloud offerings to meet the diverse needs of customers across different industries.

In conclusion, the financial crime and fraud management solutions market are experiencing notable transformations driven by advancements in technology, regulatory requirements, and changing customer demands. As organizations continue to prioritize security and risk management, market players are expected to innovate further and collaborate with industry stakeholders to develop comprehensive, AI-driven solutions that effectively combat financial crime threats. With the evolving landscape of cyber threats and regulatory challenges, the market for financial crime and fraud management solutions is poised for growth and expansion in the coming years.The financial crime and fraud management solutions market is witnessing significant transformations driven by key trends and developments. One prominent trend is the increasing focus on leveraging AI and machine learning technologies to enhance fraud detection and prevention capabilities. These advanced tools allow organizations to analyze vast amounts of data in real-time, enabling them to detect anomalies and potential fraudulent activities more effectively. As the complexity of financial transactions rises, the demand for AI-driven solutions is expected to grow, leading to innovation and increased competition among market players.

Another crucial development is the shift towards integrated platforms that offer a comprehensive approach to addressing different types of financial crimes. Integrated solutions covering fraud detection, anti-money laundering, compliance management, and risk assessment provide organizations with a centralized system for monitoring and mitigating various threats. By consolidating these functions into a single platform, businesses can streamline operations, reduce complexity, and enhance overall efficiency in managing financial crime risks.

Furthermore, regulatory compliance requirements continue to shape the landscape of the financial crime and fraud management solutions market. With stringent regulations in place to combat money laundering, fraud, and other financial crimes, organizations are under pressure to implement robust compliance programs and strategies. Market players are responding by developing solutions that not only detect and prevent fraudulent activities but also ensure adherence to regulatory standards and reporting requirements. This emphasis on compliance is propelling the adoption of comprehensive financial crime management solutions that offer both security and regulatory compliance functionalities.

Moreover, the increasing adoption of cloud-based deployment models is significantly impacting market dynamics. Cloud solutions offer organizations greater flexibility, scalability, and cost-effectiveness compared to traditional on-premises systems. This shift towards cloud deployment is driven by the need for agility and accessibility as businesses aim to stay ahead of evolving fraud schemes and cyber threats. As more companies transition to cloud-based financial crime and fraud management solutions, market players are investing in enhancing their cloud offerings to meet the diverse needs of customers across different industries.

In conclusion, the financial crime and fraud management solutions market are undergoing significant changes driven by technological advancements, regulatory requirements, and evolving customer needs. As organizations prioritize security and risk management, market players are expected to continue innovating and collaborating with industry stakeholders to develop comprehensive, AI-driven solutions that effectively combat financial crime threats. With the evolving landscape of cyber threats and regulatory challenges, the market for financial crime and fraud management solutions is poised for growth and expansion in the foreseeable future.

Gain insights into the firm’s market contribution

https://www.databridgemarketresearch.com/reports/global-financial-crime-and-fraud-management-solutions-market/companies

Financial Crime and Fraud Management Solutions Market – Analyst-Ready Question Batches

- What is the global market size of the Financial Crime and Fraud Management Solutions Market in 2025?

- What is the expected Financial Crime and Fraud Management Solutions Market value in 2032?

- What segmentation is used in the Financial Crime and Fraud Management Solutions Market analysis?

- Which brands are top contenders in this space?

- What new launches gained the most attention recently?

- Which regions are included in the global Financial Crime and Fraud Management Solutions Market map?

- Which geographic Financial Crime and Fraud Management Solutions Market is growing the fastest?

- Which countries are emerging as high-growth zones?

- What region leads in terms of profit contribution?

- What are the key challenges the Financial Crime and Fraud Management Solutions Market faces?

Browse More Reports:

Global Coated Paper Market

Global Coding and Marking Equipments Market

Global College and University Management Software Market

Global Compressor Rental Market

Global Concrete Cooling Market

Global Conjunctivitis Treatment Market

Global Consignment Software Market

Global Construction Sealants Market

Global Container Liner Market

Global Contour and Highlight Market

Global Contraceptive Devices Market

Global Contract Textile Market

Global Control Unit in Vehicle Infotainment Market

Global Controlled Release Fertilizer Market

Global Powassan (POW) Virus Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Vibnix Blog

- Politics

- News

- Liberia News

- Entertainment

- Technology

- Εκπαίδευση

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness