Faster Payment Service (FPS) Market Overview, Growth Analysis, Trends and Forecast By 2029

Detailed Analysis of Executive Summary Faster Payment Service (FPS) Market Size and Share

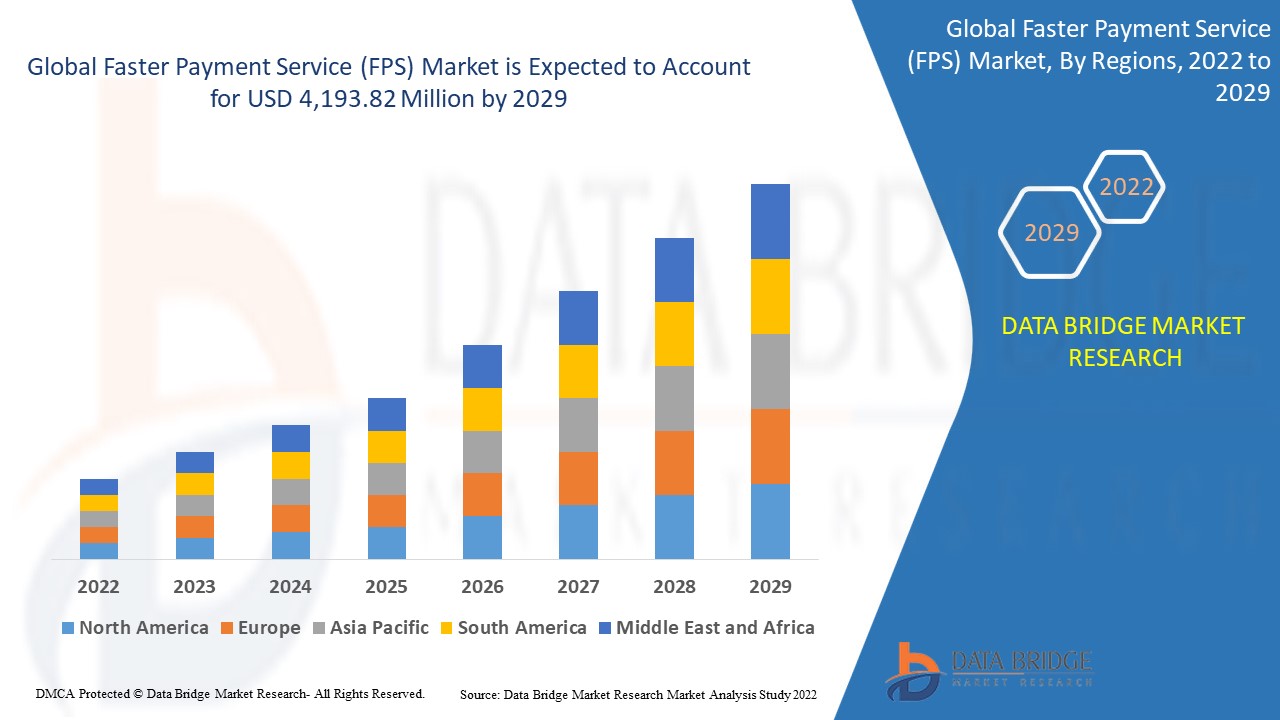

Global faster payment service (FPS) market was valued at USD 543.5 million in 2021 and is expected to reach USD 4,193.82 million by 2029, registering a CAGR of 29.10% during the forecast period of 2022-2029.

An international Faster Payment Service (FPS) Market research report is planned by gathering market research data from different corners of the globe with an experienced team of language resources. Market segmentation studies performed in this wide ranging report with respect to product type, applications, and geography are important in taking any verdict about the products. The report helps out the clients to tackle every strategic aspect including product development, product specification, exploring niche growth opportunities, application modelling, and new geographical markets. By employing up to date and proven tools and techniques, complex market insights are put forth in simpler version in the winning Faster Payment Service (FPS) Market report for the better understanding of end user.

Faster Payment Service (FPS) Market analysis report predicts the size of the market with respect to the information on key merchant revenues, development of the industry by upstream and downstream, industry progress, key companies, along with market segments and application. A study about market overview is performed by considering market drivers, market restraints, opportunities and challenges. Geographical scope of the products is also taken into consideration comprehensively for the major global areas which helps characterize strategies for the product distribution in those areas. For better decisions, more revenue generation, and profitable business, such Faster Payment Service (FPS) Market research report is the key.

Take a deep dive into the current and future state of the Faster Payment Service (FPS) Market. Access the report:

https://www.databridgemarketresearch.com/reports/global-faster-payment-service-fps-market

Faster Payment Service (FPS) Market Data Summary

**Segments**

- **By Nature**: The global Faster Payment Service (FPS) market can be segmented based on nature into bank-owned, consortium-owned, and pure payment service provider.

- **By Payment Type**: The market can be segmented by payment type into immediate payments, real-time payments, and fast payments.

- **By End-User**: End-user segments include retail, banking, financial services, and insurance (BFSI), healthcare, government, and others.

Faster payment services have gained significant traction in the global market due to the need for real-time transactions and the demand for faster payment processing. Immediate payments are gaining popularity among consumers and businesses alike, leading to the growth of the FPS market. Real-time payments are also witnessing substantial growth, driven by the increasing digitalization of payment processes and the need for instant fund transfers. Fast payments are becoming the norm, offering convenient and efficient payment solutions to users across various industries.

**Market Players**

- **FIS**: FIS is a leading player in the global FPS market, offering innovative payment solutions to its clients.

- **Mastercard**: Mastercard has been at the forefront of developing faster payment technologies, enabling seamless transactions worldwide.

- **Visa Inc.**: Visa Inc. is another key player in the FPS market, providing secure and reliable payment services to consumers and businesses.

- **PayPal Holdings, Inc.**: PayPal is a prominent player in the market, offering fast and convenient payment options to its global customer base.

- **Fiserv, Inc.**: Fiserv is a key player in the FPS market, known for its robust payment processing solutions and advanced technologies.

These market players are driving the growth of the global Faster Payment Service market through continuous innovation, strategic partnerships, and investments in emerging technologies. The increasing adoption of faster payment services, coupled with the rising demand for real-time transactions, is expected to propel the market further in the coming years.

The global Faster Payment Service (FPS) market is experiencing a paradigm shift driven by evolving consumer preferences and technological advancements. As the market continues to expand, new trends and opportunities are emerging that could reshape the landscape of faster payment services. One such trend is the increasing focus on enhancing the security and privacy of transactions in response to rising cybersecurity threats. Market players are investing heavily in robust security protocols and encryption technologies to safeguard sensitive payment data and mitigate the risks associated with fraudulent activities.

Another notable trend in the FPS market is the growing integration of artificial intelligence (AI) and machine learning (ML) capabilities to streamline payment processes and enhance customer experiences. AI-powered fraud detection systems and chatbots are being deployed to improve transaction efficiency and provide personalized support to users. Additionally, the adoption of blockchain technology is gaining momentum in the FPS market, offering decentralized and tamper-proof payment solutions that enhance transparency and reduce transaction costs.

Moreover, the emergence of Open Banking initiatives is reshaping the dynamics of the FPS market by fostering collaboration and interoperability among financial institutions and third-party service providers. Open APIs are enabling seamless data sharing and payment initiation, creating new opportunities for innovation and value creation in the financial ecosystem. Market players are actively leveraging Open Banking frameworks to develop innovative payment solutions that cater to the evolving needs of consumers and businesses.

Furthermore, the global FPS market is witnessing a proliferation of cross-border payment services that enable efficient and cost-effective international fund transfers. With the rise of e-commerce and global trade, there is a growing demand for faster and more convenient cross-border payment solutions that eliminate the complexities associated with traditional banking processes. Market players are expanding their cross-border payment offerings and exploring new partnerships to address the evolving needs of multinational businesses and consumers.

Overall, the global FPS market is poised for significant growth and transformation in the foreseeable future as market players continue to innovate and adapt to changing market dynamics. With the continued emphasis on real-time transactions, advanced security features, AI-driven customer experiences, Open Banking initiatives, and cross-border payment innovations, the FPS market is set to witness rapid evolution and expansion, shaping the future of payments on a global scale.The global Faster Payment Service (FPS) market is undergoing a significant transformation driven by evolving consumer behaviors and technological advancements. One of the key trends shaping the market is the increasing emphasis on security and privacy in transactions. With the rising instances of cybersecurity threats, market players are investing in advanced security protocols and encryption technologies to protect sensitive payment data and mitigate fraud risks. Ensuring secure and reliable payment services has become paramount in building consumer trust and driving adoption of faster payment solutions.

Another notable trend in the FPS market is the integration of artificial intelligence (AI) and machine learning (ML) capabilities. AI-powered fraud detection systems and chatbots are revolutionizing payment processes by enhancing efficiency and delivering personalized customer support. By leveraging AI and ML technologies, market players are not only streamlining payment operations but also improving overall customer experiences, thus setting new standards in the industry.

The adoption of blockchain technology is also reshaping the FPS market landscape. Blockchain offers decentralized and tamper-proof payment solutions that enhance transparency and reduce transaction costs significantly. Market players are exploring the potential of blockchain to develop innovative payment services that cater to the evolving needs of consumers and businesses. The proliferation of blockchain-based solutions is expected to drive efficiency, security, and trust in the global FPS market.

Moreover, Open Banking initiatives are playing a crucial role in redefining the dynamics of the FPS market. By promoting collaboration and interoperability among financial institutions and third-party service providers, Open Banking is fostering innovation and value creation in the financial ecosystem. Through Open APIs, seamless data sharing, and payment initiation capabilities, market players are creating new opportunities for developing customer-centric payment solutions that respond to changing market demands.

Furthermore, the expansion of cross-border payment services is addressing the growing need for efficient and cost-effective international fund transfers. The rise of e-commerce and global trade is driving the demand for faster and more convenient cross-border payment solutions, prompting market players to enhance their offerings and forge strategic partnerships. By focusing on providing seamless cross-border payment experiences, market players are catering to the evolving requirements of multinational businesses and consumers, thereby fueling growth and innovation in the global FPS market.

In conclusion, the FPS market is poised for substantial growth and evolution, characterized by enhanced security measures, AI-driven efficiencies, blockchain integration, Open Banking initiatives, and innovative cross-border payment solutions. As market players continue to innovate and adapt to changing market trends, the FPS market is set to witness rapid transformation, offering new possibilities and driving the future of payments on a global scale.

Investigate the company’s industry share in depth

https://www.databridgemarketresearch.com/reports/global-faster-payment-service-fps-market/companies

Faster Payment Service (FPS) Market Overview: Strategic Questions for Analysis

- What ratio of sales comes from loyalty programs for Faster Payment Service (FPS) Market?

- What warehouse technologies are in use?

- What are the labor challenges in Faster Payment Service (FPS) Market production?

- How are companies reducing their environmental footprint?

- Which brands have the highest Net Promoter Score for Faster Payment Service (FPS) Market?

- What AI personalization tools are most adopted?

- What’ the average distribution cost per unit?

- Which certification has the most consumer trust?

- What’s the share of impulse purchases?

- What are emerging omnichannel strategies?

- What delivery timelines are customers expecting?

- Which startups raised funding in this space recently?

- What features are being added in product upgrades?

- What are the shifts in product bundling?

Browse More Reports:

North America Gas Filtration Media Market

Middle East and Africa Flow Chemistry Market

Global Postal Automation System Market

Europe Wi-Fi Chipset Market

Global Peptide Supplements Market

Global Crystalline Silicon Cells Market

Global Hematopoietic Stem Cell Transplantation Market

Global Agarwood Essential Oil Market

Global Power Rental Market

Global Vitamin D Supplements Market

Europe Modular Kitchen Market

Global Polymyositis Treatment Market

Global Angiostrongylus Infection Treatment Market

Europe Encapsulated Calcium Propionate Market

North America Multiple Hereditary Exostosis Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Vibnix Blog

- Politics

- News

- Liberia News

- Entertainment

- Technology

- Εκπαίδευση

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness