Halal Logistics Market Scope, Market Drivers and Forecast Perspective (2024-2032) | UnivDatos

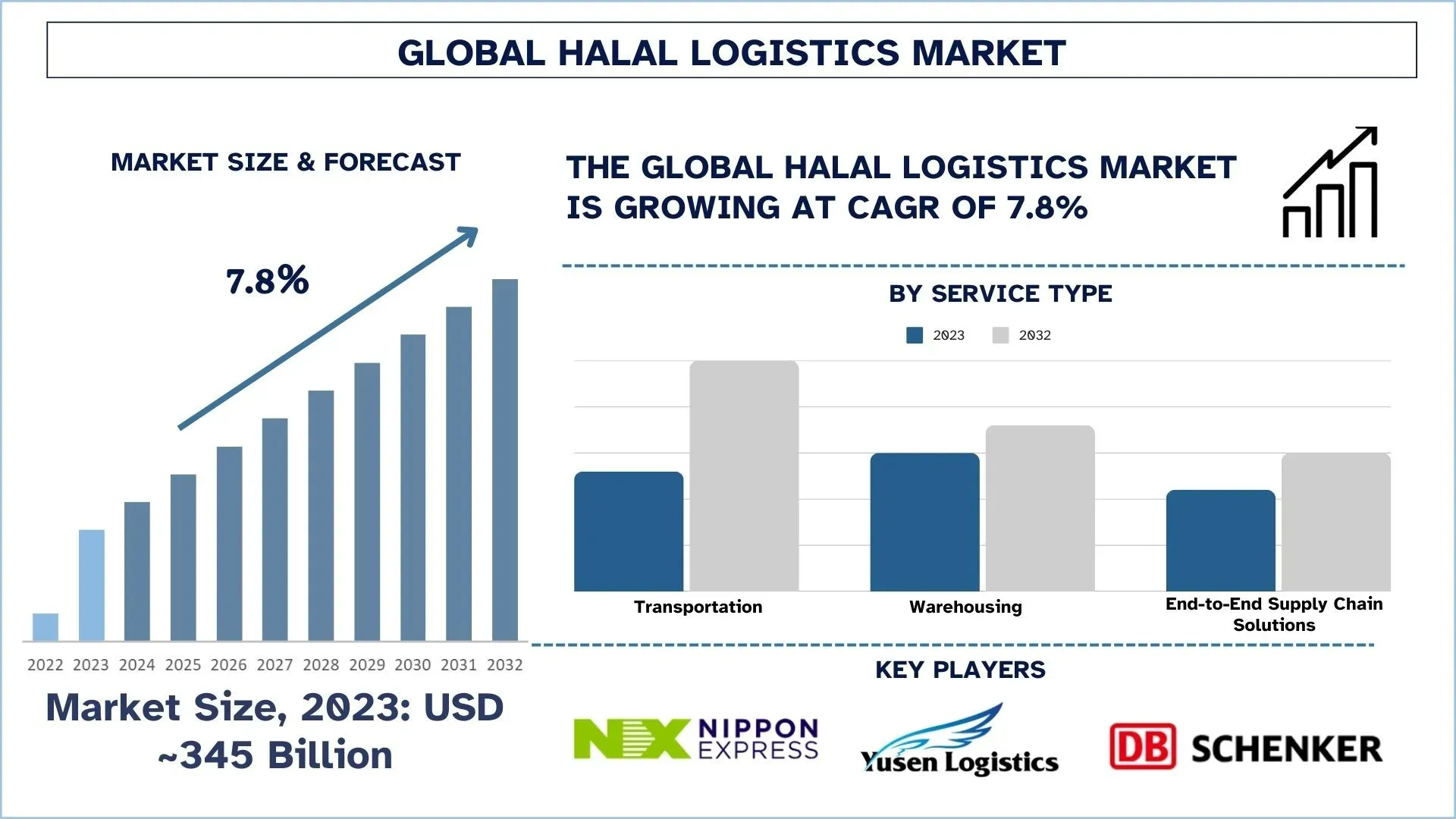

According to the UnivDatos, rising global demand for halal products, stringent regulatory frameworks, growth in the halal food sector, expanding halal pharmaceuticals and cosmetics, rising e-commerce in Muslim-majority markets, and expanding Middle Eastern and Southeast Asian markets drive the Halal Logistics market. As per their Halal Logistics Market report, the global market was valued at USD 345 Billion in 2023, growing at a CAGR of about 7.8% during the forecast period from 2024 - 2032 to reach USD Billion by 2032.

Access sample report (including graphs, charts, and figures) https://univdatos.com/reports/halal-logistics-market?popup=report-enquiry

Definition & Compliance: Halal logistics implies the procedure of transportation, storing, and distributing of products in compliance with Islamic law (Sharia) to avoid cross-contact with nonhalal products through certified means.

Rising Global Demand: The global Muslim population is forecast to rise to 2.2 billion in 2030, mainly fuelling the consumption of halal food, pharmaceuticals, and cosmetics that would require halal logistics services.

Regional Market Growth: An increase in population in Developing areas comprising Southeast Asia, the Middle East, North America, and Europe will also complement the growth of this service since regulations in these regions have positively favored halal logistics, and the general population is becoming more conscious on healthy and quality consumables.

Adoption Strategies: Halal logistics market is gaining importance as many companies are launching halal-certified warehouses, dedicated transport systems, cold-chain systems, blockchain traceability, and conducting training programs for their employees.

Technology & E-commerce Integration: The application of blockchain, IoT, and RFID improves the track and traceability of halal products while an e-commerce expansion boosts the demand for a more secure and transparent halal supply chain worldwide.

The factors responsible for the growth of halal logistics are the global Muslim population which has been estimated to be growing to 2.2 billion in 2030, making the demand for halal products in food, pharmaceuticals, and cosmetics, among others, to increase. Enhancing governmental policies and institutional demands in regions such as Southeast Asia and the Middle East to go for the Halal supply chain flow is accelerating company pressure. Also, the growth of e-marketplaces creates a demand for traceable and reliable halal logistics solutions that would meet consumer demand for genuine products and their delivery.

For instance, on March 5, 2021, Nippon Express Co., Ltd. (Mitsuru Saito, President) expanded its domestic halal logistics services in Japan with the start of a new halal-certified domestic air cargo transport service on March 8.Japan's Muslim population numbers about 200,000 and, with an increase in foreign visitors/residents from a diversity of cultural backgrounds anticipated, demand for halal products in Japan is expected to rise. High certification standards for quality assurance and hygiene control have also expanded interest in halal products among health- and safety-conscious consumers.

Segments that transform the industry

Based on service type, the market is segmented into transportation {roadways, railways, airways, seaways}, warehousing, and end-to-end supply chain solutions. The transportation held a significant share of the market in 2023. It plays a vital role in the development of halal logistics by guaranteeing that products, specifically perishable items such as halal meat and food, are transported without coming into contact with non-halal items. This is due to the growing need for Halal foods in international trade and the advancement of internet food-selling platforms in various Muslim-dominated countries. Manufacturers respond by using exclusive halal-certified vehicles, sealed containers, as well as GPS to track the vehicles used in the transport of the products. Furthermore, the establishment of temperature-controlled halal supply chain logistics is also gaining more investments as the various parties in the supply chain strive to meet halal requirements from end to end.

Click here to view the Report Description & TOC https://univdatos.com/reports/halal-logistics-market

According to the report, the impact of Halal Logistics has been identified regulations now:

India’s new halal meat export guidelines:

In a major regulatory shift for India’s meat export industry, the country has introduced new policy conditions for halal meat exports, effective from October 16, 2024. The updated guidelines, announced by the Directorate General of Foreign Trade (DGFT) on October 1, 2024, specify that meat products can only be exported to 15 key markets—Bahrain, Bangladesh, Indonesia, Iran, Iraq, Kuwait, Malaysia, Jordan, Oman, the Philippines, Qatar, Saudi Arabia, Singapore, Turkey, and the UAE—if they are processed in facilities certified under the ‘India Conformity Assessment Scheme (I-CAS) – Halal.’

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

LinkedIn- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Vibnix Blog

- Politics

- News

- Liberia News

- Entertainment

- Technology

- EĞİTİM BİLGİLERİ

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness