Europe Usage-Based Insurance Market Insights | How the Industry is Evolving Towards 2032

Executive Summary Europe Usage-Based Insurance Market :

Executive Summary Europe Usage-Based Insurance Market :

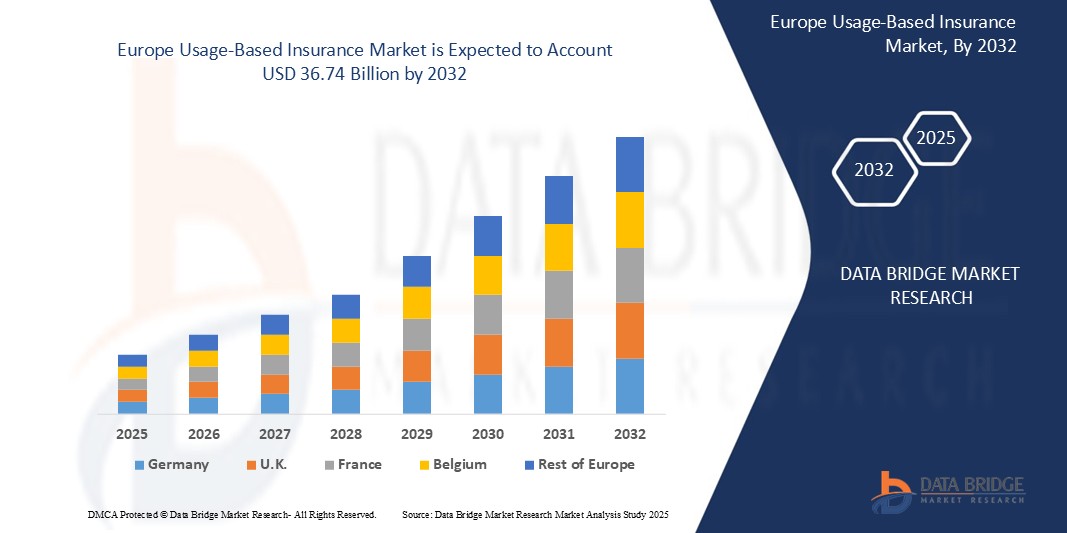

The Europe Usage-Based Insurance Market size was valued at USD 10.01 billion in 2024 and is expected to reach USD 36.74 billion by 2032, at a CAGR of 17.65% during the forecast period

The market insights and market analysis about industry, made available in this Europe Usage-Based Insurance Market research report are rooted upon SWOT analysis on which businesses can depend confidently. This market study underlines the moves of key market players like product launches, joint ventures, developments, mergers and acquisitions which is affecting the market and Industry as a whole and also affecting the sales, import, export, revenue and CAGR values. The consistent and extensive market information of this report will definitely help grow business and improve return on investment (ROI). This report makes available an actionable market insight to the clients with which they can create sustainable and profitable business strategies.

The Europe Usage-Based Insurance Market report makes your business well acquainted with insightful knowledge of the global, regional and local market statistics. By keeping end users at the centre point, a team of researchers, forecasters, analysts and industry experts work exhaustively to formulate this market research report. To achieve maximum return on investment (ROI), it’s very crucial to figure out brand awareness, market landscape, possible future issues, industry trends and customer behaviour and Europe Usage-Based Insurance Market report does the same. This Europe Usage-Based Insurance Market report conveys the company profiles, product specifications, capacity, production value, and market shares of each company for the forecasted period.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Europe Usage-Based Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/europe-usage-based-insurance-market

Europe Usage-Based Insurance Market Overview

**Segments**

- By Package Type: Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD)

- By Vehicle Type: Passenger Vehicle, Heavy-Duty Vehicle

- By Device Offering: OBD-II-based, Smartphone-based, Hybrid

- By Technology: Black-Box, Smartphone, Embedded System

The Europe usage-based insurance market is segmented based on various factors that play a crucial role in determining the market growth and opportunities within the region. The segmentation by package type includes Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD), offering different options for consumers based on their driving habits. When it comes to vehicle type, the market is segmented into passenger vehicles and heavy-duty vehicles, catering to different segments of the market. The device offering segmentation includes OBD-II-based, smartphone-based, and hybrid options, giving consumers varied choices for monitoring their driving behavior. Lastly, the segmentation by technology consists of black-box, smartphone, and embedded system solutions, showing the technological diversity within the market.

**Market Players**

- Allianz

- AXA

- Liberty Mutual Insurance Company

- Progressive Casualty Insurance Company

- Allstate Insurance Company

- State Farm Mutual Automobile Insurance Company

- Desjardins Insurance

- Insure The Box Limited

- Mapfre

- Metromile

- National General Insurance

- Nationwide Mutual Insurance Company

- Octo Telematics

- TomTom Telematics

- UnipolSai Assicurazioni S.p.A.

Some of the leading market players in the Europe usage-based insurance market include Allianz, AXA, Liberty Mutual Insurance Company, Progressive Casualty Insurance Company, Allstate Insurance Company, State Farm Mutual Automobile Insurance Company, Desjardins Insurance, Insure The Box Limited, Mapfre, Metromile, National General Insurance, Nationwide Mutual Insurance Company, Octo Telematics, TomTom Telematics, and UnipolSai Assicurazioni S.p.A. These players are actively involved in driving innovation and competition within the market, offering a wide range of products and services to cater to the evolving needs of consumers in the region.

The Europe usage-based insurance market is experiencing significant growth and transformation due to the increasing adoption of telematics technology and the changing preferences of consumers towards more personalized insurance solutions. Market players are leveraging advancements in data analytics, artificial intelligence, and IoT to offer innovative products that provide real-time feedback on driving behavior, leading to risk mitigation and cost savings for both insurers and policyholders. The shift towards usage-based insurance models is driven by the need for more accurate pricing based on individual driving habits, fostering a more equitable and transparent insurance industry.

One of the key trends shaping the Europe usage-based insurance market is the growing acceptance of pay-how-you-drive (PHYD) and manage-how-you-drive (MHYD) policies, which offer consumers more control over their premiums based on their actual driving performance. This shift towards behavior-based insurance is driving competition among market players to develop sophisticated monitoring devices and analytics platforms that can accurately assess risk and reward safe driving behaviors. Insurers are also exploring new partnerships with automakers, technology companies, and fleet operators to expand their customer base and enhance the value proposition of usage-based insurance products.

Moreover, the segmentation by vehicle type, such as passenger vehicles and heavy-duty vehicles, highlights the diverse market opportunities within the Europe region. Insurers are focusing on developing tailored solutions for different vehicle categories, addressing specific risk factors and regulatory requirements to meet the evolving needs of commercial and personal vehicle owners. The adoption of OBD-II-based, smartphone-based, and hybrid device offerings further underscores the technological innovation driving the uptake of usage-based insurance in Europe, empowering consumers to make informed decisions about their coverage options and driving habits.

As market players continue to invest in research and development, customer engagement, and regulatory compliance, the Europe usage-based insurance market is poised for sustained growth in the coming years. The collaboration between insurers, technology providers, and regulatory bodies will be essential in shaping the future of usage-based insurance, ensuring the delivery of flexible, affordable, and customer-centric solutions that promote road safety and sustainability. With the increasing digitization of the insurance industry and the demand for personalized services, market players must stay agile and adaptive to seize new opportunities and maintain their competitive edge in the dynamic Europe market landscape.The Europe usage-based insurance market is experiencing a paradigm shift driven by advancements in telematics technology and changing consumer preferences towards personalized insurance solutions. Market players are leveraging data analytics, artificial intelligence, and IoT to offer innovative products that provide real-time feedback on driving behavior, leading to risk mitigation and cost savings for both insurers and policyholders. The adoption of usage-based insurance models is gaining traction due to the demand for more precise pricing based on individual driving habits, fostering a fairer and more transparent insurance sector.

A key trend shaping the Europe usage-based insurance market is the rising popularity of pay-how-you-drive (PHYD) and manage-how-you-drive (MHYD) policies, empowering consumers to control their premiums based on actual driving performance. This shift towards behavior-based insurance is spurring competition among market players to develop advanced monitoring devices and analytics platforms capable of accurately assessing risk and rewarding safe driving behaviors. Insurers are forging strategic partnerships with automakers, technology firms, and fleet operators to broaden their customer base and enhance the value proposition of usage-based insurance products.

The segmentation based on vehicle types, such as passenger vehicles and heavy-duty vehicles, underscores the diverse market potential in Europe. Insurers are tailoring solutions for different vehicle categories to address specific risk factors and regulatory requirements, meeting the evolving needs of commercial and personal vehicle owners. The adoption of OBD-II-based, smartphone-based, and hybrid device offerings showcases the technological innovation fueling the uptake of usage-based insurance, empowering consumers to make informed decisions regarding their coverage options and driving habits.

As market players continue to invest in R&D, customer engagement, and regulatory compliance, the Europe usage-based insurance market is poised for sustained growth. Collaboration among insurers, tech providers, and regulatory bodies will be crucial in shaping the future of usage-based insurance by delivering flexible, affordable, and customer-centric solutions that promote road safety and sustainability. With the industry's increasing digitalization and demand for personalized services, market players must remain agile and adaptive to capitalize on new opportunities and maintain their competitive edge in the dynamic European market landscape.

The Europe Usage-Based Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/europe-usage-based-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Regional Analysis/Insights

- The Europe Usage-Based Insurance Market is analyzed and market size insights and trends are provided by country, component, products, end use and application as referenced above.

- The countries covered in the Europe Usage-Based Insurance Market reportare U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

- North America dominatesthe Europe Usage-Based Insurance Market because of the region's high prevalence Europe Usage-Based Insurance Market

- Asia-Pacific is expectedto witness significant growth. Due to the focus of various established market players to expand their presence and the rising number of surgeries in this particular region.

Browse More Reports:

North America Operating Room Equipment Supplies Market

Global Anisocoria Treatment Market

Global Nucleic Acid Therapeutics, Sport Food Additives and Skin Care Market

Global Reed Sensor Market

Global Micro Server Integrated Circuit (IC) Market

Global Fusion Beverage Market

Middle East and Africa Pharmaceutical Isolator Market

Global Skincare Packaging Market

Global Optical Films Market

Global Emergency Shutdown Systems Market

Global Automated Material Handling Market

Global Clamshell Packaging Market

Global Firenze Square Jars Market

Middle East and Africa Fitness Equipment Market

Global DDI (DNS, DHCP, and IPAM) Market

Global Monk Fruit Sweetener Market

Global Sugar Decorations and Inclusions Market

Global Shock Absorption Running Shoes Market

Global Chloroform Market

Global Graphite Market

Global Flexographic Printing Market

Asia-Pacific Contrast Media Injectors Market

Global Business Jet Market

Asia-Pacific Automated Material Handling Market

Asia-Pacific Weighing and Inspection Market

North America Drug Delivery Devices Market

Global Spinal Fusion Market

Global Elbow Lesion Treatment Market

Global Natural Extracts Market

Global Adenomyosis Treatment Market

Global Nanoelectromechanical Systems (NEMS) Market

Global Lab-On-A-Chip Market

Global Food Halal Ingredients Market

Global Trash Can Liner Market

Europe Health Screening Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Vibnix Blog

- Politics

- News

- Liberia News

- Entertainment

- Technology

- Educación

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness