Canada General Insurance Market Size, Share, Trends & Forecast 2030

The Canada General Insurance Market reports delivers an in-depth assessment of market size, share, and emerging trends, offering valuable insights into growth opportunities. It examines market segmentation and definitions, highlighting core components and key drivers of expansion. By applying SWOT and PESTEL analyses, the study evaluates the sector’s strengths, weaknesses, opportunities, and threats, while also considering political, economic, social, technological, environmental, and legal factors. Expert reviews of competitor strategies and recent developments provide a clearer view of regional dynamics and future market trajectories, establishing a strong foundation for strategic planning and informed investment decisions.

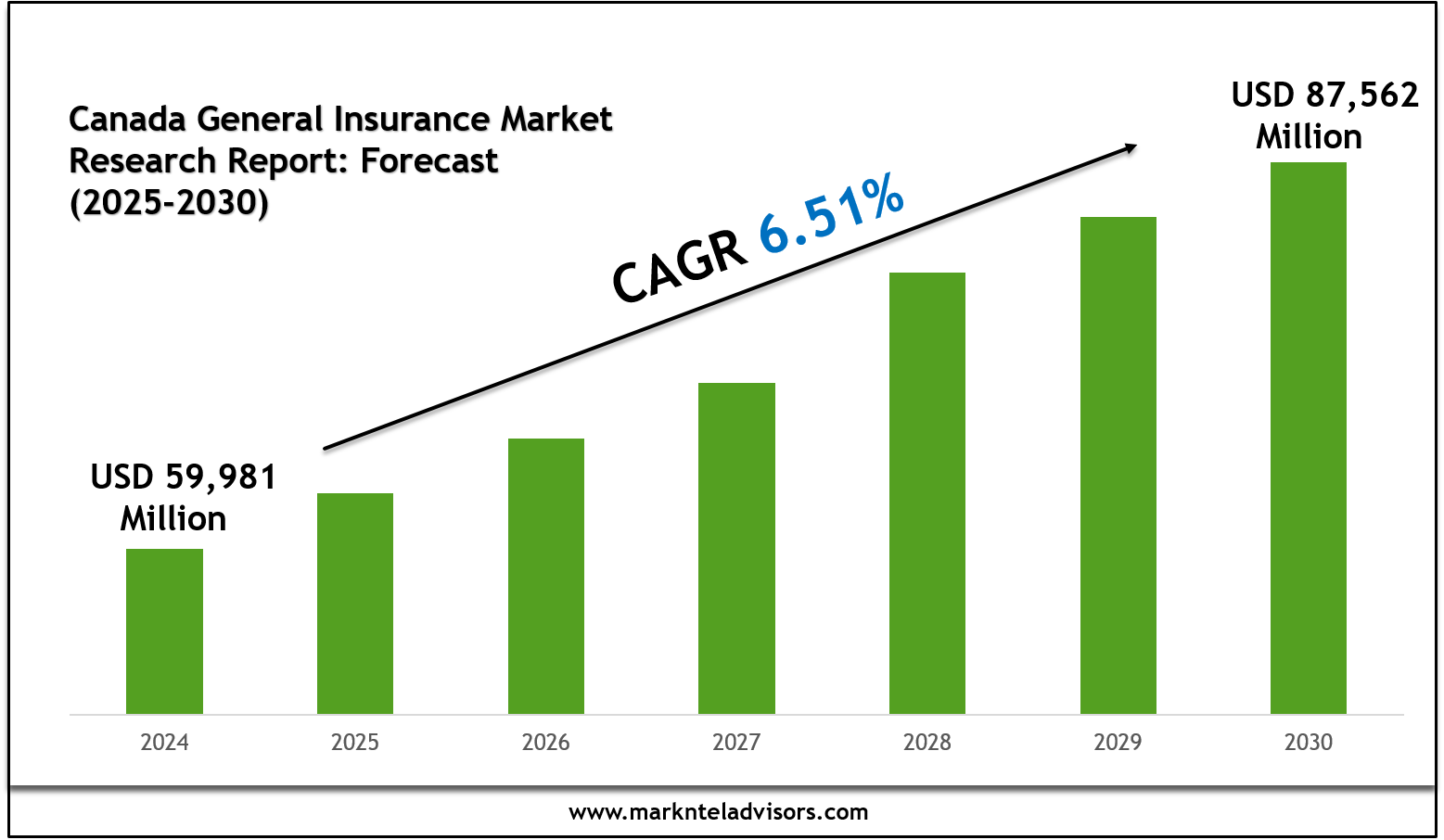

What will be the market size of Canada General Insurance market 2030?

The Canada General Insurance Market size was valued at around USD 59,981 million in 2024 and is projected to reach USD 87,562 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.51% during the forecast period, i.e., 2025-30.

Download Free PDF Brochure: https://www.marknteladvisors.com/query/request-sample/canada-general-insurance-market.html

Who are the top companies operating in the Canada General Insurance market?

The report features prominent companies operating in the Canada General Insurance market and the successful strategies they have adopted. It also provides detailed insights into each company’s market share and their role in driving the industry’s growth. As per MarkNtel Advisors, top companies in Canada General Insurance market: TD Insurance, Intact Financial Corporation, Aviva Canada, The Co-operators, Wawanesa Mutual Insurance, Definity Financial, Northbridge Financial, Allstate Canada, Chubb Canada, Zurich Canada, and others are the top companies in the Canada General Insurance Market.

What is the key factor projected to fuel growth in the Canada General Insurance Market between 2025 and 2030?

Rising Awareness About the Losses Due to Catastrophic Events – The rising frequency of natural disasters such as hurricanes, floods, wildfires, storms, etc. has caused substantial losses and raised awareness among the citizens of the country to protect their legacy, health, and property. It has increased the demand for general insurance in Canada. As per the Insurance Bureau of Canada (IBC) (2022), the Derecho storm caused more than USD675 million of losses to the areas of Ontario and Quebec in Canada. Additionally, the drastic events of flooding in Nova Scotia in 2023 have caused about USD170 million in infrastructural damage.

Canada General Insurance Market - Segmentation Analysis

- By Insurance Type (Home, Motor, Health, Others),

- By Distribution Channel (Direct, Agency, Banks, Online, Others),

- By End User (Individual Customers, Commercial and Industrial) and Others

Browse Full Research Report: https://www.marknteladvisors.com/research-library/canada-general-insurance-market.html

How does the Canada General Insurance Market vary across different geography?

By Region

- North

- East

- West

- South

This Section cover detailed analysis of revenue, market share and growth rate, historical data (2020-23) and forecast (2025-2030) of the following segmentation and geography.

Inquire Before Buying, Connect with our Expertise Today: https://www.marknteladvisors.com/query/talk-to-our-consultant/canada-general-insurance-market.html

Comprehensive Table of Contents – Canada General Insurance Market Analysis and Forecast, 2030

- Table 1: Introduction

- Table 2: Executive Summary

- Table 3: Market Regulations, Policies & Standards

- Table 4: Canada General Insurance Market Size, Share & Scope, 2020-2030F

- Table 5: Market Trends & Developments

- Table 6: Market Dynamics (Key Drivers, and Challenges)

- Table 7: Market Hotspots & Opportunities

- Table 8: Market Value Chain Analysis

- Table 9: Market Outlook, 2020-2030F

- Table 10: Market Size & Analysis by Revenues (USD Million):

- Table 11: Market Size & Forecast 2020–2030 by Segmentation

- Table 12: Market Size & Forecast 2020–2030 by Geography

- Table 13: Key Strategic Imperatives for Success & Growth

- Table 14: Competitor Analysis of Canada General Insurance Companies

Key Benefits for Industry Participants and Stakeholders

- Insight into emerging market trends and investment opportunities

- Understanding of regional market dynamics and competitive landscapes

- Data-driven forecasts to support strategic decision-making

- Access to industry benchmarks for performance evaluation

- Identification of potential risks and growth challenges

Browse More Reports:

APAC Non-Invasive Ventilators Market

- APAC Non-Invasive Ventilators Market Research Report: Forecast (2025-2030)

- Italy Electric Scooter Market Research Report: Forecast (2025-2030)

About Us:

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

Contact Us:

MarkNtel Advisors

Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

Contact No: +91 8719999009

Email: sales@marknteladvisors.com

- Vibnix Blog

- Politics

- News

- Liberia News

- Entertainment

- Technology

- Education

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness