India Motor Insurance Market Demand, Claims Technology Trends and Forecast (2024-2032) |UnivDatos

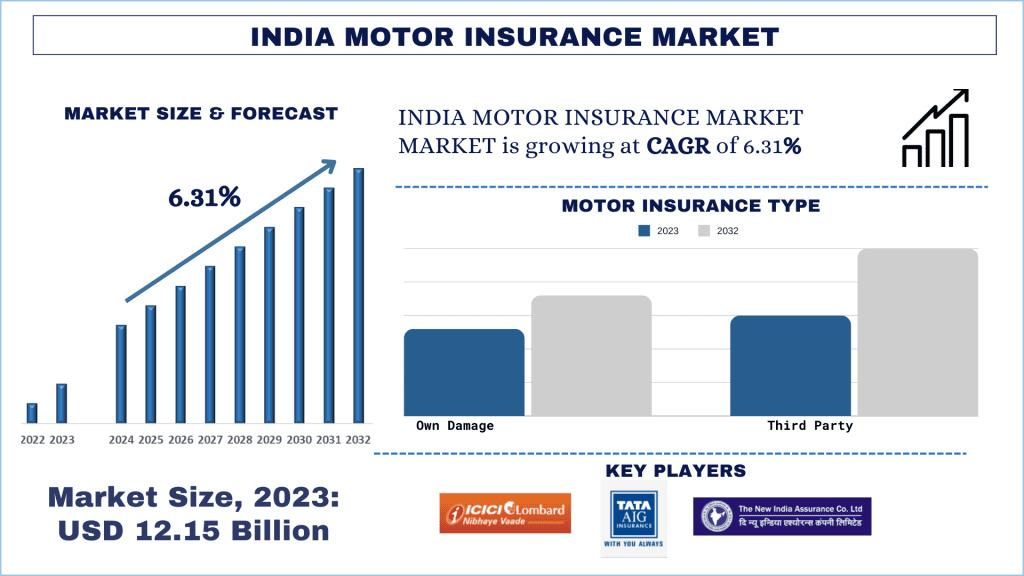

According to a new report by UnivDatos, Motor Insurance Market is expected to reach USD Billion in 2032 by growing at a CAGR of 6.31%. The rising demand for sustainable and flexible packaging materials has assisted the growth of the Motor Insurance market. Additionally, the country has witnessed the growth of end-user industries such as the automotive, pharmaceutical, food & beverages sectors, which would further increase the share of Motor Insurance in the coming period.

Access sample report (including graphs, charts, and figures) https://univdatos.com/reports/india-motor-vehicle-insurance-market?popup=report-enquiry

Growing Demand:

One of the factors that has been majorly attributed to market growth is the increasing demand for Motor Insurance is the rise of automotive sectors. With the rising sales of automobiles and the mandatory government policies to opt for motor insurance of both type the motor insurance sector has received a sizeable momentum.

Automotive sector in India is witnessing a rapid growth due to rising middle-class population as well as increasing disposable income in the country. With the rising young population there a growing pool of automotive buyers in the country every year. Considering the demand for both commercial as well as private vehicles the automotive market in the country has flourished in the recent years. The market has also significantly benefitted with the various government policies supporting the ease of ownership among the buyers.

From the aforementioned figure we can infer that the demand for automobiles in India has witnessed a sustained increase between 2021 to 2023. Economic revival after the COVID-19 pandemic is one of the key factors that promoted the market growth.

Additionally, with the robust growth the automobile sector has received a massive increase in the FDI inflow which would further promote the manufacturing to cater to rising needs of automobiles in the country.

For instance, according to the government of India Automobile Sector received increase of 5.34% of the total FDI inflow as per the Mar 2024 The Department for Promotion of Industry and Internal Trade (DPIIT).

Additionally, various government policies and regulatory support are also developing frameworks to support the adoption of Motor Insurance. This also includes guidelines for safety and operations, which would help the motor insurance demand to grow and help the Motor Insurance market in the long run.

Applications:

Motor insurance plays a pivotal role in securing the hefty cost associated with repairing vehicles in case of an accident. As the traffic on Indian roads increases, there is a growing risk of vehicles getting struck by other vehicles, which could lead to both minor and major damages. To reduce the cost of damages, motor insurance pays the insured sum, which saves the customers from additional financial burdens.

Additionally, in recent years, customers have shifted towards the purchase of premium to semi-premium vehicles both in the two-wheeler and four-wheeler categories. This vehicle damage could significantly heighten the cost of repair, due to which there is a growing customer base for long-term own-damage motor insurance.

Technological Innovation:

Various new technologies have been implemented in India's motor insurance market. Of these, AI and digitalization for easy customer acquisition and customer handling are prominent. AI-based chatbots and other related technologies are being extensively used by motor insurance companies to cater to many clients for customer redressal, easy Q&A handling, product-related issues, redressal, etc. Considering these shifts, the general insurance companies have significantly reduced the burden on their existing workforce, using it on other productive work.

Some of the recent developments that have expedited the usage of digitalization and AI technologies by general insurance companies are as follows:

In 2022, IRDAI permitted general insurance companies to introduce Pay As You Drive, Pay How You Drive, and floater policies for vehicles belonging to the same owners with two-wheelers and cars as add-ons in a motor insurance policy.

In 2023, ICICI Lombard launched its AI-based Claim Your Claim digital campaign. The campaign was aimed at tapping underpenetrated markets for general insurance in India.

Additionally, the insurance companies seeking digital solutions for easy customer handling and customer acquisition would further improve and assist India Motor Insurance market growth in the forecasted years, i.e., 2024-2032.

Click here to view the Report Description & TOC https://univdatos.com/reports/india-motor-vehicle-insurance-market

Conclusion:

In conclusion, the India Motor Insurance market is poised for continued growth and innovation driven by economic expansion, end-user industry growth, technological advancements, and sustainable practices. The increasing demand for vehicle insurance, as well as the need for improved long-term motor insurance in the automobile industry, underscores the pivotal role of Motor Insurance across India. As stakeholders navigate challenges such as cost management, regulatory compliance, and market competitiveness, collaborations, investments in Motor Insurance infrastructure, and rising demand from the automobile sector would also play a vital role in shaping the future of the India Motor Insurance market, ensuring its resilience and contribution.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

LinkedIn- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Vibnix Blog

- Politics

- News

- Liberia News

- Entertainment

- Technology

- Education

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness