Financial Crime and Fraud Management Solutions Market Size, Share, Trends and Forecast by 2029

Executive Summary Financial Crime and Fraud Management Solutions Market :

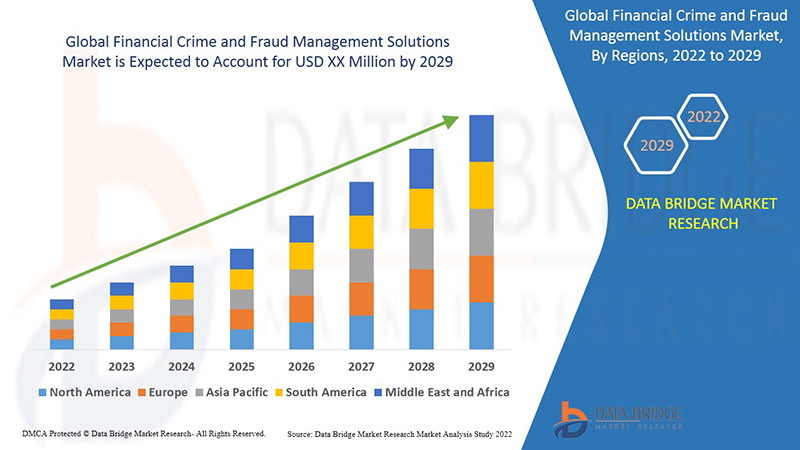

Data Bridge Market Research analyses that the financial crime and fraud management solutions market will exhibit a CAGR of 4.7% for the forecast period of 2022-2029.

Transparent, trustworthy and extensive market information and data included in this report will definitely help develop business and improve return on investment (ROI). This Financial Crime and Fraud Management Solutions Market report provides an exhaustive survey of key players in the market which is based on a range of objectives of an organization such as profiling, the product outline, the quantity of production, required raw material, and the financial health of an organization. One of the sections in the report covers evaluation of probabilities of the new investment projects and overall research conclusions are offered.

Financial Crime and Fraud Management Solutions Market report helps the firm in exploring new uses and new markets for its existing products and thereby, increasing the demand for its products. This global market report offers research and consulting services focused on achieving competitive leverage, with acquiring and preserving market position as key aims of the program. The base year for calculation in the report is taken as 2017 and the historic year is 2016 which will tell you how the Financial Crime and Fraud Management Solutions Market is going to perform in the forecast years by informing you what the market definition, classifications, applications, and engagements are.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Financial Crime and Fraud Management Solutions Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-financial-crime-and-fraud-management-solutions-market

Financial Crime and Fraud Management Solutions Market Overview

**Segments**

- By Component: The financial crime and fraud management solutions market can be segmented based on components into software and services. The software segment includes various solutions such as fraud detection, money laundering detection, compliance management, and risk management software. The services segment comprises professional services like consulting, implementation, and support services.

- By Deployment Mode: This market can also be classified by deployment mode into cloud-based and on-premises solutions. Cloud-based solutions are gaining popularity due to their scalability, cost-effectiveness, and ease of implementation, while on-premises solutions offer better control and customization options.

- By End-User: The market serves various industries such as banking, financial services, insurance, healthcare, retail, government, and others. Each industry has unique fraud detection and prevention requirements, leading to a diverse range of solutions in the market.

**Market Players**

- SAS Institute Inc.: SAS offers a comprehensive suite of fraud detection and financial crime management solutions that leverage advanced analytics and machine learning algorithms to detect anomalies and suspicious activities in real-time.

- Nice Actimize: Nice Actimize provides end-to-end fraud management solutions for financial institutions, leveraging artificial intelligence and automation to prevent fraudulent activities across digital channels.

- FICO: FICO offers a range of fraud detection and prevention solutions that help organizations identify, investigate, and mitigate financial crimes effectively.

- BAE Systems: BAE Systems provides financial crime solutions that combine artificial intelligence, machine learning, and big data analytics to help organizations combat money laundering, fraud, and other financial crimes.

- IBM Corporation: IBM offers a suite of financial crime management solutions that leverage cognitive computing and data analytics to enhance fraud detection and prevention capabilities.

The global financial crime and fraud management solutions market is witnessing significant growth due to the increasing complexity and sophistication of financial crimes. With the rise of digital transactions and online banking, the risk of fraud has also grown, leading organizations to invest in advanced solutions to protect their assets and customers. The market is characterized by continuous technological advancements, such as the integration of artificial intelligence, machine learning, and data analytics to enhance fraud detection capabilities.

The market players are focusing on developing innovative solutions that can adapt to evolving fraud patterns and regulatory requirements. Collaborations, partnerships, and acquisitions are common strategies employed by key players to expand their market presence and offer a comprehensive portfolio of financial crime management solutions. Moreover, the increasing adoption of cloud-based solutions and the rising demand for real-time fraud detection are driving the market growth.

Overall, the global financial crime and fraud management solutions market is poised for substantial growth in the coming years, driven by the increasing awareness among organizations about the importance of robust fraud detection and prevention mechanisms. With the continuous evolution of financial crimes, market players are expected to continue innovating and enhancing their solutions to stay ahead of fraudulent activities and safeguard the financial ecosystem.

The global financial crime and fraud management solutions market is undergoing a transformation driven by the surge in digital transactions, online banking, and the increasing sophistication of financial crimes. One emerging trend within this market is the integration of blockchain technology to enhance security and transparency in financial transactions. By leveraging blockchain's immutable ledger capabilities, organizations can track and authenticate transactions in real-time, reducing the risk of fraud and enhancing regulatory compliance. This shift towards blockchain-based solutions is gaining traction among financial institutions looking to fortify their fraud management strategies and ensure secure transactions in the digital landscape.

Another significant development in the financial crime and fraud management solutions market is the rise of behavioral analytics. By analyzing user behavior patterns, organizations can detect anomalies and flag suspicious activities in real-time, enabling proactive fraud prevention measures. Behavioral analytics leverage machine learning algorithms to identify unusual patterns or deviations from normal behavior, helping organizations thwart fraudulent activities before they escalate. This innovative approach to fraud detection is reshaping the industry by providing a more dynamic and adaptive solution to combat evolving fraud schemes.

Furthermore, regulatory compliance remains a key driver shaping the financial crime and fraud management solutions market. As financial regulations continue to evolve and tighten worldwide, organizations are under increasing pressure to uphold compliance standards and mitigate financial risks. Consequently, there is a growing demand for solutions that offer robust compliance management features, automated reporting capabilities, and adherence to regulatory requirements. Market players are adapting their offerings to encompass comprehensive compliance modules that streamline regulatory processes and ensure adherence to global standards.

Moreover, the convergence of artificial intelligence and big data analytics is revolutionizing fraud management practices within the financial sector. By harnessing the power of AI and leveraging vast data sets, organizations can enhance their fraud detection capabilities, identify emerging fraud patterns, and mitigate risks effectively. AI-driven solutions enable real-time monitoring, predictive analytics, and decision-making support, empowering organizations to stay ahead of fraudulent activities and safeguard their assets.

In conclusion, the global financial crime and fraud management solutions market is witnessing a paradigm shift driven by technological advancements, regulatory complexities, and evolving fraud landscapes. The adoption of blockchain technology, behavioral analytics, regulatory compliance solutions, and AI-powered fraud detection mechanisms are reshaping the industry and empowering organizations to combat financial crimes more effectively. Moving forward, market players are expected to continue innovating and integrating cutting-edge technologies to address emerging challenges and ensure robust fraud management practices in an increasingly digitized financial ecosystem.The global financial crime and fraud management solutions market is currently undergoing a significant transformation driven by the increasing complexity and sophistication of financial crimes. One of the key trends shaping the market is the integration of blockchain technology to enhance security and transparency in financial transactions. By leveraging blockchain's immutable ledger capabilities, organizations can track and authenticate transactions in real-time, reducing the risk of fraud and enhancing regulatory compliance. This adoption of blockchain-based solutions is gaining momentum among financial institutions seeking to bolster their fraud management strategies in the digital era.

Another noteworthy development in the market is the growing importance of behavioral analytics in fraud detection. By analyzing user behavior patterns using machine learning algorithms, organizations can identify anomalies and suspicious activities in real-time, enabling proactive fraud prevention measures. Behavioral analytics offer a dynamic and adaptive approach to fraud detection, allowing organizations to thwart fraudulent activities before they escalate. This innovative use of data and analytics is reshaping the industry by providing a more sophisticated and responsive way to combat evolving fraud schemes.

Furthermore, regulatory compliance requirements continue to play a crucial role in shaping the financial crime and fraud management solutions market. As global financial regulations become more stringent and complex, organizations face mounting pressure to uphold compliance standards and mitigate financial risks effectively. This has led to a rising demand for solutions that offer robust compliance management features, automated reporting capabilities, and adherence to regulatory requirements. Market players are adapting by enhancing their offerings with comprehensive compliance modules to streamline regulatory processes and ensure adherence to evolving standards.

Additionally, the convergence of artificial intelligence and big data analytics is revolutionizing fraud management practices within the financial sector. By harnessing the power of AI and utilizing vast datasets, organizations can strengthen their fraud detection capabilities, identify emerging fraud patterns, and mitigate risks efficiently. AI-driven solutions enable real-time monitoring, predictive analytics, and decision-making support, empowering organizations to stay ahead of fraudulent activities and safeguard their assets effectively. This fusion of AI and analytics represents a significant advancement in fraud management, offering organizations the tools they need to combat financial crimes in a rapidly evolving landscape.

In conclusion, the global financial crime and fraud management solutions market is experiencing a paradigm shift characterized by technological innovations, regulatory challenges, and evolving fraud landscapes. The adoption of blockchain technology, behavioral analytics, compliance management solutions, and AI-powered fraud detection mechanisms are reshaping the industry and empowering organizations to combat financial crimes more effectively. Going forward, market players are expected to continue driving innovation and leveraging advanced technologies to address emerging threats and ensure robust fraud management practices in an increasingly digital financial environment.

The Financial Crime and Fraud Management Solutions Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-financial-crime-and-fraud-management-solutions-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Table of Contents:

- Financial Crime and Fraud Management Solutions Market Overview

- Economic Impact on Industry

- Competition by Manufacturers

- Production, Revenue (Value) by Region

- Supply (Production), Consumption, Export, Import by Regions

- Production, Revenue (Value), Price Trend by Type

- Market by Application

- Manufacturing Cost Analysis

- Industrial Chain, Sourcing Strategy and Downstream Buyers

- Financial Crime and Fraud Management Solutions Market Strategy Analysis, Distributors/Traders

- Financial Crime and Fraud Management Solutions Market Effect Factors Analysis

- Financial Crime and Fraud Management Solutions Market Forecast

- Appendix

Browse More Reports:

Global Sputtering Targets and Evaporation Materials Market

North America Heart Failure Software Market

Global Tumor Lysis Syndrome Market

Global Synchronous Drum Market

Global Sentiments Analytics Market

Global Organic Saffron Market

North America Laser Projection Systems Market

Global Atherectomy and Intravascular Lithotripsy (IVL) Devices Market

Global Tea Pods and Capsules Market

North America Silicon on Insulator Market

Global Cannabidiol (CBD) Skin Care Market

Global Biodegradable Film Market

Middle East and Africa Coated Paper Market

North America Molecular Diagnostics Services Market

North America Glucose Monitoring Devices Market

North America Polypropylene Market

Global Pellagra Market

Global Roll Trailer Market

Global Contour and Highlight Market

Asia-Pacific Cartoning Machines Market

Global Oxygen Barrier Films and Coatings for Dry Food Market

Global Asthma Spacers Market

Global Optometry/Eye Exam Equipment Market

Global Low Temperature Powder Coatings Market

Potato Chips Market

Europe Minimally Invasive Surgical Instruments Market

Global Marfan Syndrome Treatment Market

Global Polystyrene Market

Global Cheese Substitute Market

Global Catalyst Handling Services Market

Asia-Pacific Enterprise File Synchronization and Sharing Market

Global Radiological Diagnostics Market

Global Connected Packaging Market

Middle East and Africa Ophthalmology Devices Market

Global Silent Thyroiditis Market

Global 5G Substrate Materials Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Vibnix Blog

- Politics

- News

- Liberia News

- Entertainment

- Technology

- Ausbildung

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness